In 2023, turnover in European bicycle sales declined due to lower numbers sold. Last year, price erosion was the main cause of lower turnover.

Data from some of Europe’s national federations of bicycle manufacturers and distributors show a pattern emerging: discounting is eating into margins and turnover.

After a record-breaking year in 2022 that saw demand for bicycles peak in Europe, a sharp drop in units sold was recorded in 2023 throughout the continent. First numbers published in Germany, the Netherlands, Belgium, Switzerland the United Kingdom indicate that 2024 remained challenging for Europe’s bicycle business, albeit for different reasons. While inflation has come down, consumer sentiment has not recovered after a dip in October 2023 due to the ongoing war in Ukraine and the Middle East still in turmoil. The aggressive posturing of the Trump administration and the threat of tariffs on consumer goods and raw materials imported into the United States added to the uncertainty.

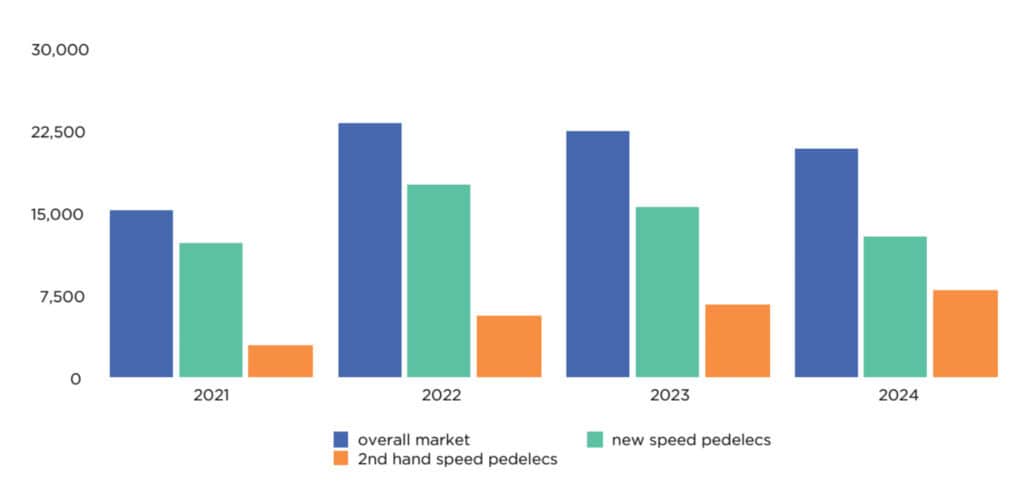

As a consequence of the pandemic-induced boom, bicycle markets in various countries have been saturated, keeping demand low for the time being. This is particularly true for mountain bikes without electric support and urban e-bikes, segments that are currently gathering dust in warehouses. While speed pedelecs still are a hard sell in Germany due to strict rules, this category also lost momentum in Belgium and the Netherlands. One bright spot was strong growth in second-hand sales of speed pedelecs in Belgium, due to leasing companies selling refurbished e-bikes that have been returned after three-year-contracts expired.

Premium road bikes and gravel bikes were selling well in 2024, however, without granting any discounts. The numbers presented by premium road bike brands Pinarello and Colnago for 2023 were surprisingly good, and the sales of drop-bar bikes were one ray of hope in Germany, Belgium, the Netherlands and Switzerland. Sporty light-support e-bikes were also doing well. This segment is pretty young and the market is still expanding rather than being saturated. Lastly, services and repairs from brick and mortar shops were in high demand to keep all those bicycles running smoothly that had been bought during the pandemic.

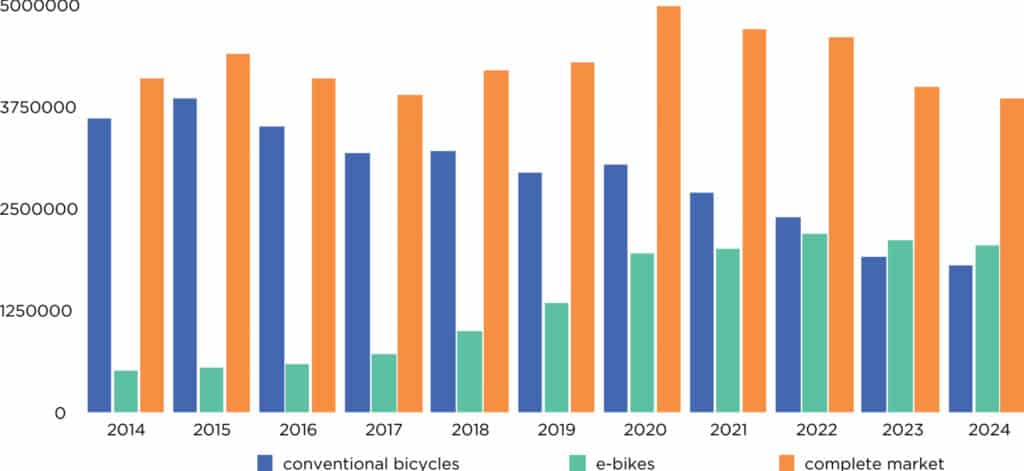

Germany’s Zweirad Industrie Verband (ZIV) recently presented its market data for 2024 at an online press conference. According to ZIV’s numbers, Germany’s bicycle market dropped by 2.53 percent year-on-year to 3.85 million units. Accounting for a market share of 53 percent, a total of 2.05 million e-bikes were sold last year, equaling a year-on-year decline of 2.4 percent. The market for conventional bicycles was down by 5.3 percent to 1.8 million units. Thus, after last year’s drop by 13 percent, the decline could be slowed down when looking at the units only. But unfortunately that is not the full story.

A look at the turnover shows that the German bicycle market contracted by 10.3 percent to €6.33bn. To put things into perspective, that is still is more than 50 percent higher than the turnover in 2019. The gap between units sold and turnover generated hints at the tough discounting that has ongoing in 2024. From independent bicycle dealers to brands banking on D2C sales and hypermarkets, all market players had to sacrifice some margin in order to clear or at least reduce their inventories. This also shows in the average sales prices where e-bikes dropped by 10.2 percent to €2,650, while conventional bicycles saw an increase by 6.4 percent to €500.

At least the discounting had the intended effect, as the number of e-bikes and conventional bicycles stored in warehouses were reduced by 690,000 units, giving manufacturers, distributors and bicycle dealers some air to breathe. One consequence of this is that Germany’s domestic production was down by 13.8 percent year-on-year, with the production of e-bikes declining by 14.8 percent and that of conventional bicycles by 11.7 percent. Germany’s exports were down by 10 percent in units as well, with e-bikes only losing 5 percent and conventional bicycles dropping by 15 percent. Imports were down by almost 30 percent, with only marginal differences between e-bikes and conventional bicycles.

As for the origin of the bicycles imported to Germany, 53 percent of conventional bicycles originated from other EU countries and 40 percent from Asia, with Cambodia, Bangladesh and China as the most important suppliers. The big winners were Portugal and India. As for e-bikes, the situation is vastly different, with EU countries accounting for 75 percent of Germany’s imports, up from 70 percent the year before, and Asia down to 21 percent. Germany’s leading European e-bike suppliers are the Czech Republic, Bulgaria, Hungary and the Netherlands, while Vietnam and Taiwan are the most important exporters in Asia.

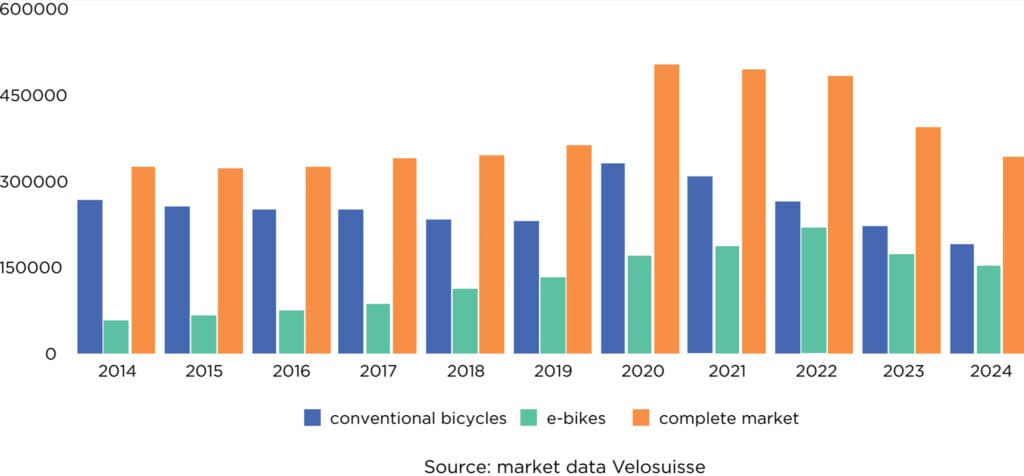

Switzerland’s bicycle market contracted by about 54,000 units or 13.6 percent year-on-year to 341,142 units. E-bikes were down by 12 percent to 151,772 units, representing a market share of 44.5 percent. With conventional bikes, the units sold dropped by 15 percent to 189,370 units. In its press release, the national vendors organization Velosuisse points at a partly saturated market, low consumer sentiment and a very wet spring season that slowed down the sell-off of inventory. At the same time, the change of ownership at the Bike World chain of stores and the resulting discounting put considerable pressure on margins.

After a decade of dynamic growth, the bicycle market in the Netherlands showed a significant contraction in 2024. According to data published by the federation Bovag and RAI, units sold stood at 858,126 at the end of the year, a 7-percent decline year-on-year. But turnover generated by the sales of bicycles only dropped by 4 percent to €1.55bn as the average price per unit sold grew by 3 percent to €1,809. As the number of e-bikes sold dropped by 9 percent to 409,467 units, the market share slid under 50 percent again. Still the sales of e-bikes accounted for 72 percent of the turnover of all bicycle sales as the average price of e-bikes increased by 5 percent year-on-year to €2,719.

There is one caveat in the Dutch numbers as the fat bike category was only introduced in 2020, complicating comparisons with years before. These fat bikes, almost all with e-drive systems, are defined by small-diameter wheels clad with extra-wide tires and a seat bench made to accommodate two adults. In 2024, a total of 111,033 fat bikes were sold in the Netherlands, accounting for 13 percent of the units sold. Most of these fat bikes are sold through D2C channels, and many do not comply with EU regulations as they come with an accelerator throttle and tampering with the maximum speed is way too easy.

As for Belgium’s market, the national federation Traxio and market research company GfK presented preliminary findings in mid-January at the Velofollies festival based on a January to November comparison. According to these findings, consumer sentiment in Belgium remained low in 2024, and the weather was not helpful either as this was one of the wettest years ever on record. According to the report of Traxio and GfK, the overall market contracted by 8.2 percent year-on-year, with e-bikes only losing 5.9 percent and conventional bicycle sales dropping by 11.6 percent in units.

The market share of e-bikes grew to almost 61 percent while the turnover from the sales of bicycles and e-bikes dropped by 5.8 percent to €691.6 million. The sales of speed pedelecs were down significantly by 17.5 percent year-on-year, but the second-hand sales were up by 18.3 percent, mainly due to expiring leasing contracts and refurbished models hitting the market.

The United Kingdom’s Bicycle Association also gave some advance information on how the bicycle market performed in 2024. Bicycle sales continued to drop to levels not seen since the turn of the millennium, with the sales of conventional bicycles down by 4 percent to 1.45 million and e-bike sales down by 5 percent to 146,000 units, representing a market share of a scant 9 percent. On a positive note, the rate of annual decline began to ease in 2024 compared with previous years, market performance flattened during the second half after a tough first half and services and repairs were in high demand.

Topics in this article

More news and updates from The Show Daily team

- Greenway Battery: A Focus on Product Longevity and Smart Sustainability

- Seven Things to Expect from Eurobike 2025

- Kenda Tires: From Local Manufacturer to Global Player

- E-Bike Motors 2025: Innovation and Competition Drive the Market Forward

- Knowledge, Networks, New Directions: What to Expect from the Eurobike 2025 Specialist Program