Taiwan’s once-booming bicycle industry is facing a harsh reality: exports have taken a nosedive in 2023, leaving warehouses overflowing with unsold inventory and manufacturers fearing a full-blown crash. But is this just a temporary skid or a sign of deeper troubles? Let’s delve deeper into the factors at play and explore the prospects for recovery.

The Perfect Storm:

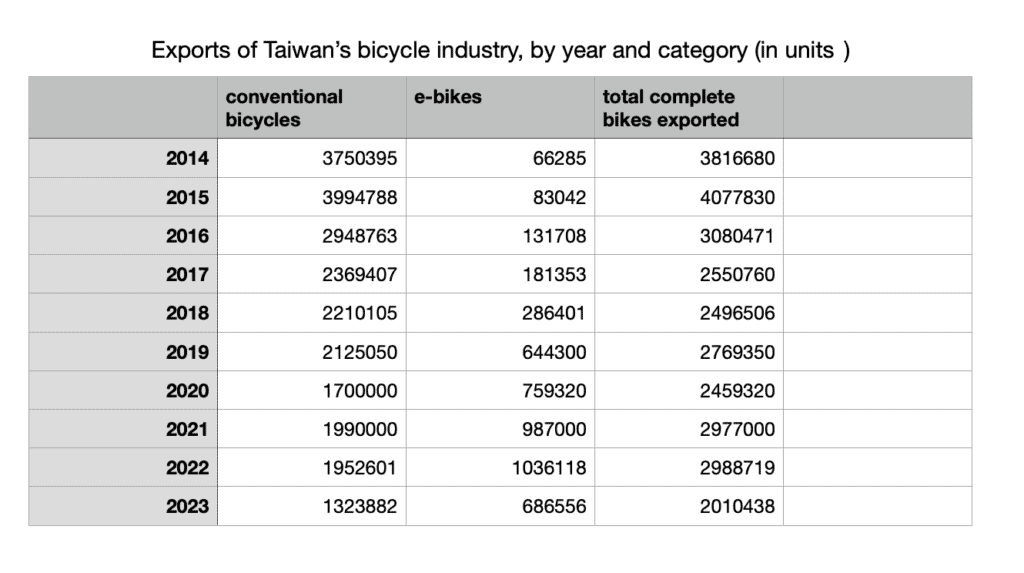

The industry is caught in a vicious cycle of oversupply and dwindling demand. The “pork cycle” phenomenon saw manufacturers, anticipating sustained pandemic-fueled growth, ramp up production in 2022. However, as economies reopened and consumer sentiment soured due to rising costs, demand abruptly declined. This oversupply was further amplified by the “bullwhip effect”, where amplified signals of increased demand along the supply chain led to inflated production, creating a glut of bikes.

Black Swan Events and Statistical Smoke & Mirrors:

Adding to the chaos were a series of unpredictable events like the Ukraine war and lingering pandemic disruptions, acting as “black swan” events that further disrupted supply chains and consumer confidence. Comparisons to the record-breaking years of 2020-2022 paint a misleading picture. Analyzing data from 2019, the last “normal” year, offers a more accurate perspective.

Market Segments Feel the Pinch Differently:

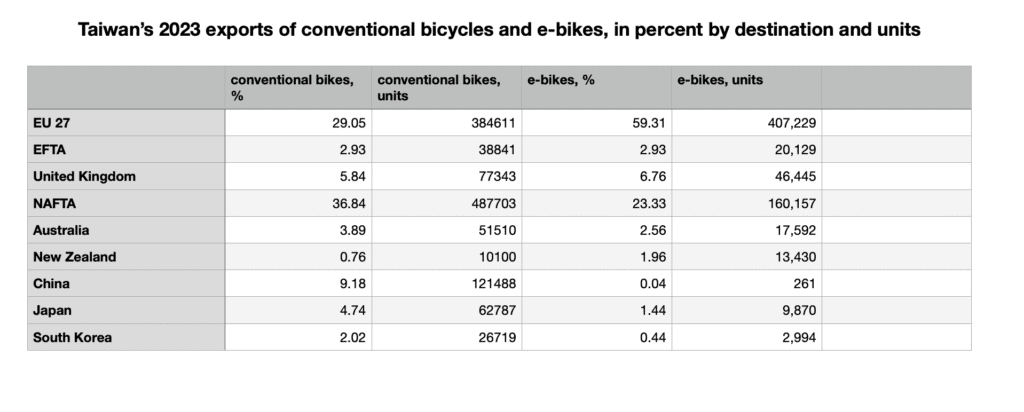

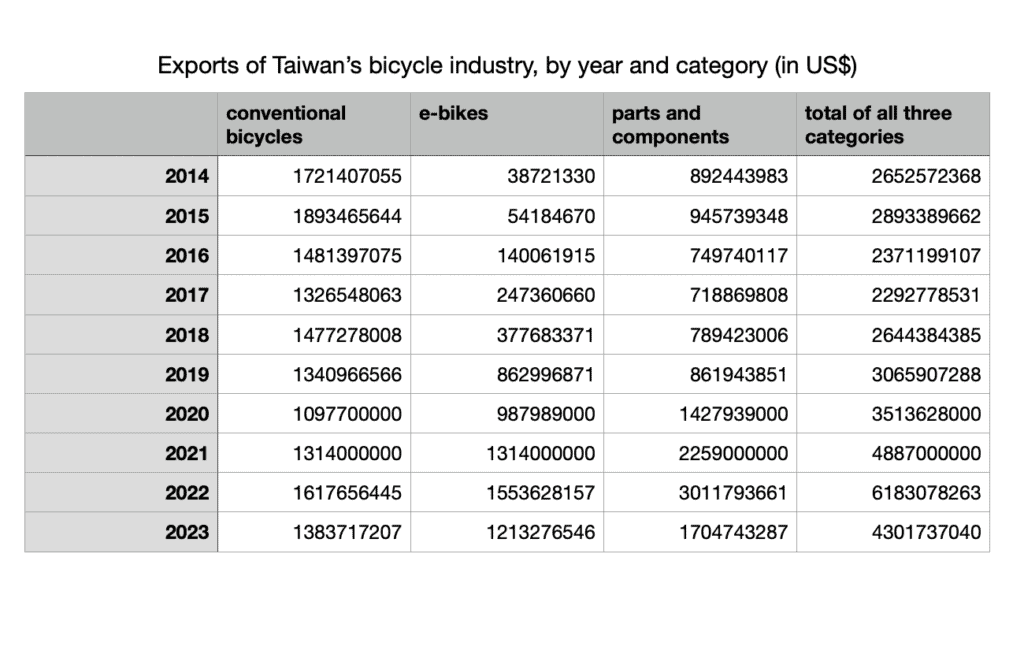

The e-bike market, initially a bright spot, saw a 33% drop in unit exports, though the higher average price softened the blow in terms of value. Conventional bikes fared worse, with exports down 32% in units and 14% in value. However, the 26% average price hike suggests a shift towards premium segments.

Parts & Components: Ground Zero of Overstock:

The parts and components sector, the industry’s backbone, suffered the most. Exports plummeted 51.6% in weight and 41.4% in value, reflecting the massive overstock issue. Even imports fell significantly as assembly plants reduced production.

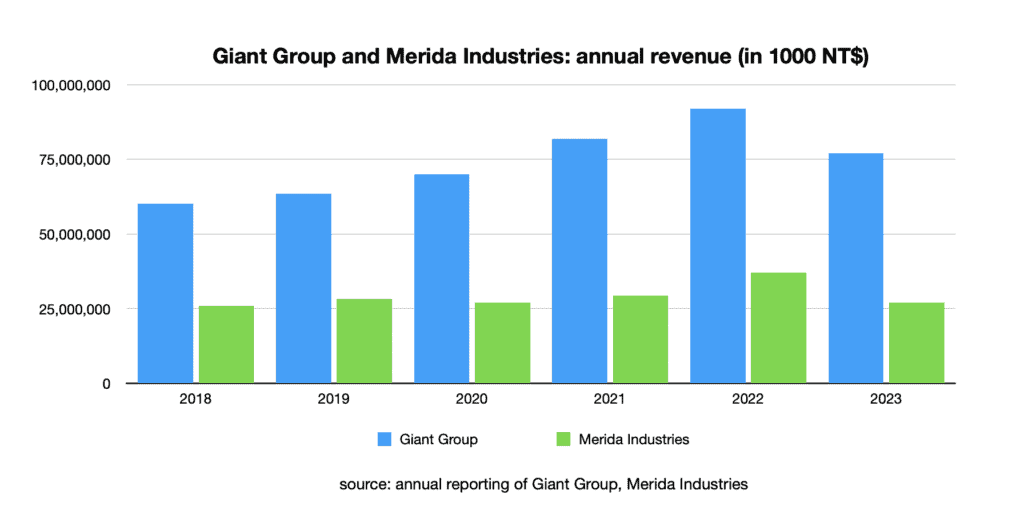

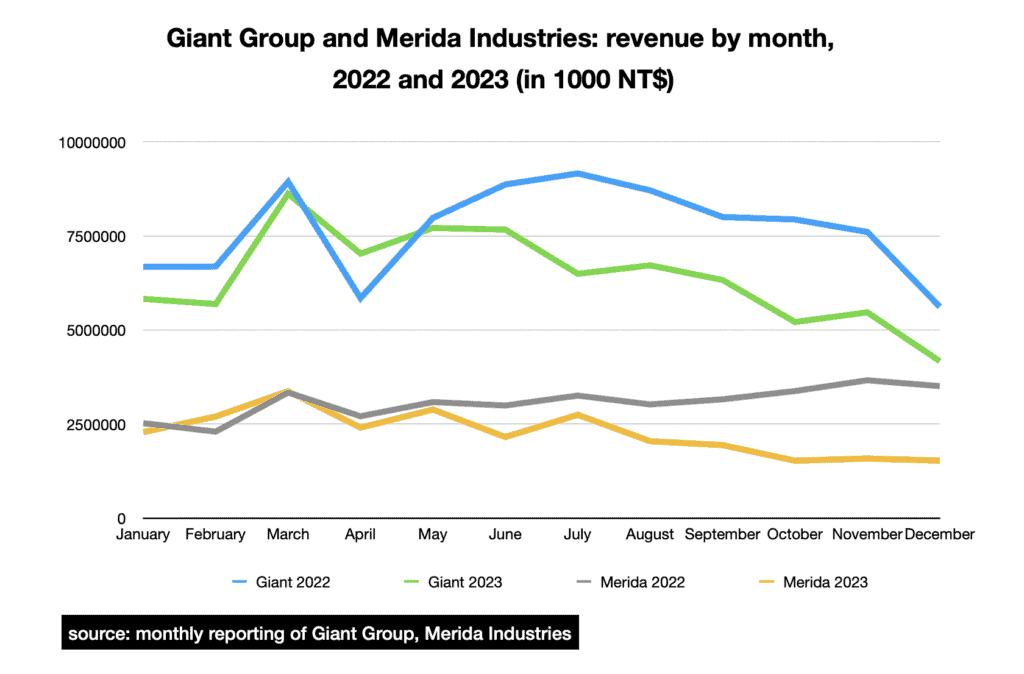

Industry Giants Feeling the Heat:

Major players like Giant and Merida have not been spared. Their turnover saw declines in the second half of 2023, with Giant experiencing a 29.8% drop in Q4. This can be attributed to late 2023 model deliveries and strategic delays in introducing 2024 models to avoid market saturation.

China: A Temporary Blip?

China stands out as a curious case. Conventional bike exports to China doubled in 2023. However, this is likely a temporary surge due to the lifting of zero-covid policies, and unlikely to be sustained given China’s own economic challenges.

Beyond the Horizon: Glimmer of Hope or Looming Storm?

While the short-term outlook seems bleak, industry leaders remain cautiously optimistic. They point to favorable long-term factors:

- Increasing e-bike adoption in the US: As consumers discover the advantages of e-bikes, demand is expected to rise.

- Growing consumer interest in cycling: Initiatives promoting health and sustainability are driving more people towards cycling.

- Taiwan’s robust production capacity: Despite the current slump, Taiwan’s factories are well-equipped for future growth.

However, navigating the road to recovery will require:

- Inventory management: Clearing existing stock through strategic promotions and targeted marketing.

- Production adjustments: Aligning production with real-time demand to avoid further oversupply.

- Innovation: Diversifying product offerings and focusing on niche markets with growth potential.

- Cost optimization: Streamlining operations and exploring cost-effective sourcing to remain competitive.

The Verdict: An Uneven Road Ahead

The bicycle industry faces an uneven road ahead. Overcoming the current obstacles will require agility, adaptability, and strategic foresight. While the possibility of a full-blown wipeout cannot be entirely discounted, the industry’s inherent resilience and long-term potential offer a glimmer of hope. If it can power through the current skid and navigate the challenging terrain, Taiwan’s bicycle industry may very well reclaim its dominance on the two-wheeled landscape.