Rising costs and delays plague global trade as shipping companies bypass Red Sea

A simmering conflict in the Middle East is throwing a wrench into the delicate machinery of global trade, with ripples reaching as far as the bicycle industry. The recent escalation of hostilities in the Red Sea was sparked by attacks on civilian vessels by Houthi rebels in Yemen. The global bicycle industry is facing a fresh wave of challenges as the ongoing conflict in the Red Sea disrupts crucial shipping routes. Rising costs, extended delays, and limited cargo space are squeezing margins and testing the resilience of bike companies already grappling with complex issues.

Critical Artery Disrupted

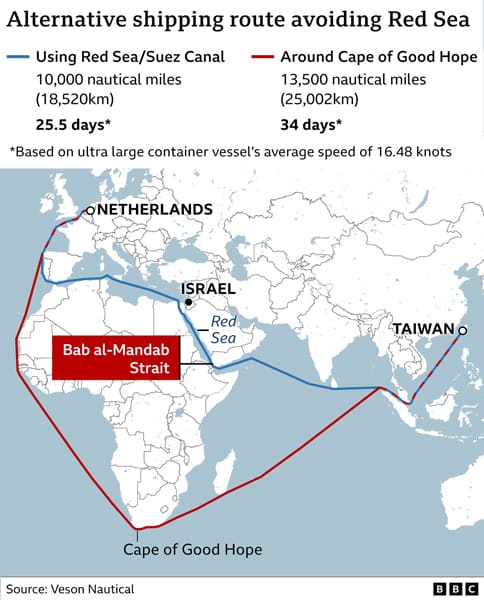

The Red Sea, including the Suez Canal, serves as a vital artery for global trade, carrying roughly 12% of all sea freight and an even higher percentage of goods traveling from the Far East, where many bicycle components are manufactured, to Europe, a major market for finished bicycles.

Forced Rerouting, Rising Costs

Following attacks on civilian vessels by Houthi rebels in Yemen, major shipping companies like Maersk and Hapag-Lloyd have been forced to bypass the Red Sea altogether, opting for the longer route around the Cape of Good Hope. This decision, while ensuring safety, has come at a significant cost:

Extended Delivery Times

Rerouting cargo can add one to three weeks to delivery times, creating logistical headaches for bicycle companies and potentially delaying the arrival of new models for eager customers.

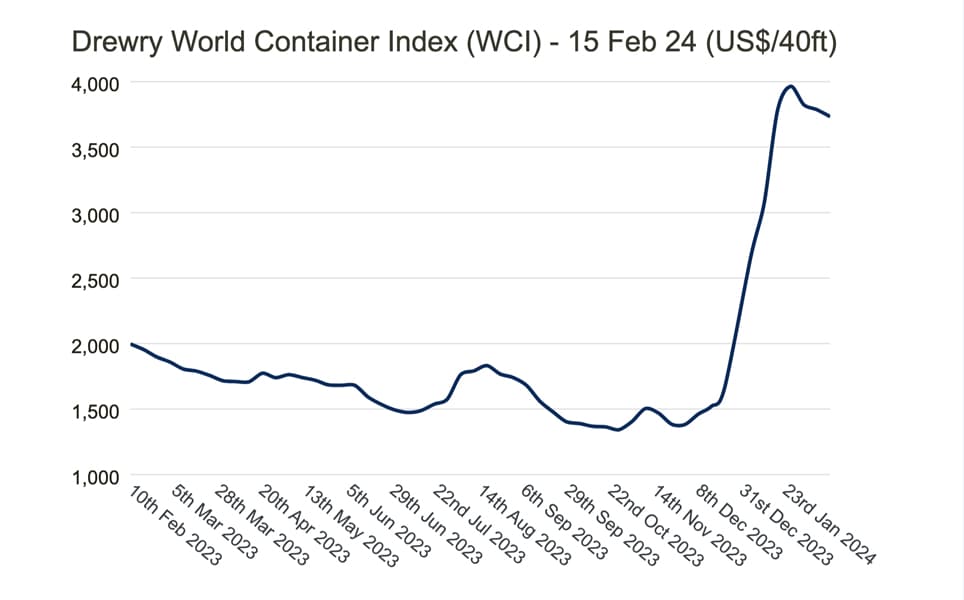

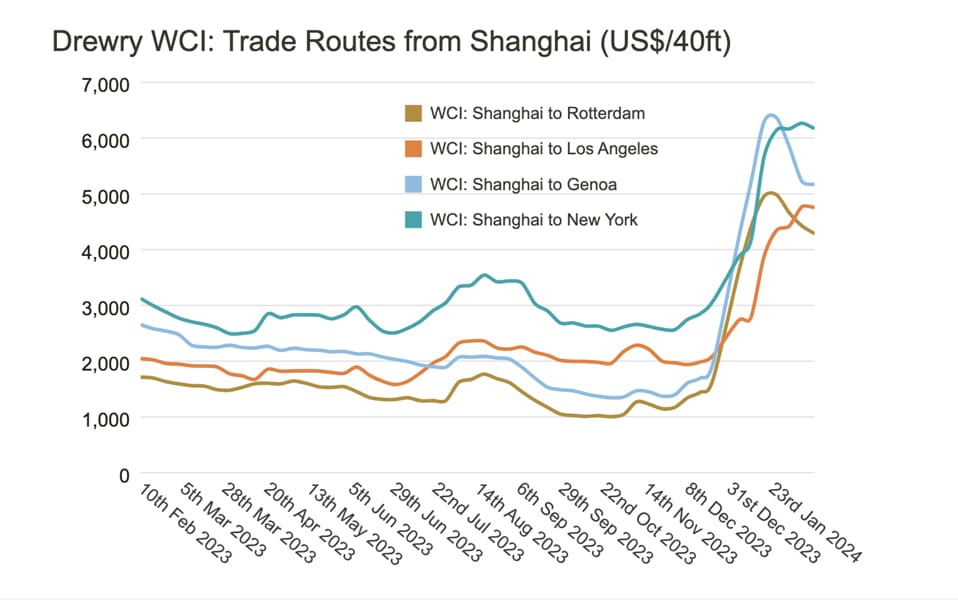

Spiking Costs

The longer journey translates to higher fuel costs for shipping companies, which are then passed on to consumers in the form of increased freight rates. This puts pressure on already tight profit margins for bicycle companies, as Bonnie Hsiao, Assistant General Manager at Castello Cycle, explains: “We anticipate the costs for sea freight to rise again due to the situation in the Red Sea, and it will also cause shipments to be harder to get.”

Limited Cargo Space, Strategic Shifts

As some ships remain docked in the Far East due to the volatile situation, competition for available cargo space has intensified, further impacting costs and adding to the logistical maze. This has forced some bicycle companies to consider alternative strategies, as Jeff Chen, General Manager at Novatec, outlines: “Our customers understand the problem, and they are checking more carefully on our lead time and capacity in order to arrange shipping in advance. Or they choose to go for other shipping routes to avoid the risk.”

Industry Adapts, Customers Wait

While some companies explore alternative transport options like airfreight or rail, most have little choice but to wait for their sea shipments. This has led to increased customer awareness of potential delays and a need for greater transparency from businesses, as Velo’s CEO, Ann Chen, highlights: “Fortunately we have not heard any of our customers’ shipments being attacked, but many are facing problems with longer shipping times. At Velo, we try our best to ship products early to meet customer needs.”

Uncertain Future, Enduring Impact

While international intervention aims to ensure safe passage in the Red Sea, the long-term security of the region remains an open question. For the bicycle industry, the Red Sea conflict adds another layer of uncertainty and exacerbates existing cost pressures, highlighting the industry’s vulnerability to global disruptions.