With the current overstocking issues, the state of key bicycle markets is a decisive factor in reducing inventory and improving liquidity. How have some of Taiwan’s most important export markets been doing recently?

The market surveys of national federations of bicycle manufacturers and distributors for 2022 remain the latest available, covering a year that saw the industry go from a constant scarcity of goods amidst massive demand to a serious collapse in consumer sentiment and high inventory levels along the entire supply chain. These high inventory levels have had a serious impact on cashflow, causing liquidity issues and eating away at margins as products threaten to become obsolete while they collect dust in the warehouse.

Aggravating the situation was higher-than-expected inflation that peaked at 10 percent in key bicycle markets such as the European Union, the United Kingdom and the United States. As the cost of living went up rapidly, people postponed purchases of consumer durables – such as bicycles and e-bikes. To make matters worse, a sizeable number of people who had bought a bicycle during the pandemic to commute, exercise or for use in active holidays were now selling their bicycles second-hand, further affecting retail sales. These negative factors were not sufficiently offset by factors such as surging gas prices and subsidies for the purchase of e-bikes or cargo bikes offered mostly on a communal level.

Due to the combination of decreased turnover and high operating costs a number of companies have already gotten into serious trouble this year. Those operating with low margins and heavily relying on investors and lending were the most vulnerable, lacking the reserves needed to weather the storm. Companies with a clear focus on the upper-end of the market and e-bikes on the other hand did not suffer as badly as those serving the low to mid end of the market and not selling any e-bikes at all. As a consequence, business in countries with a high market share for e-bikes and a high average price for conventional bicycles was not down as much as in other countries.

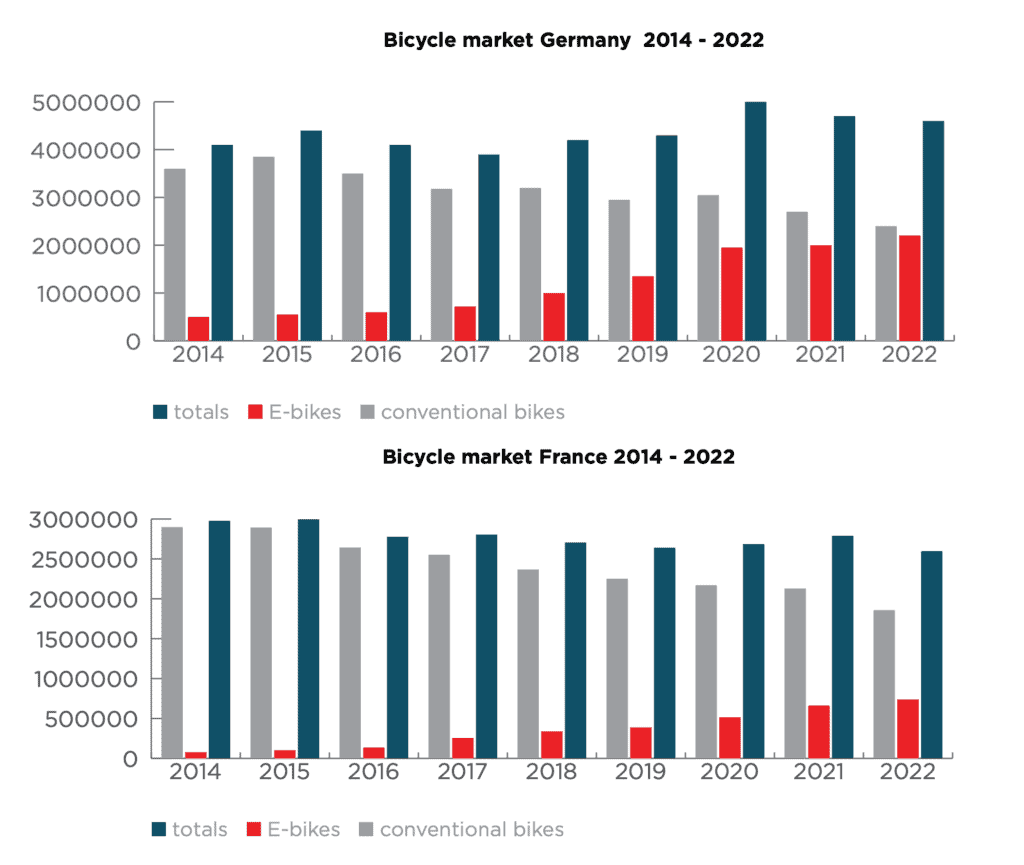

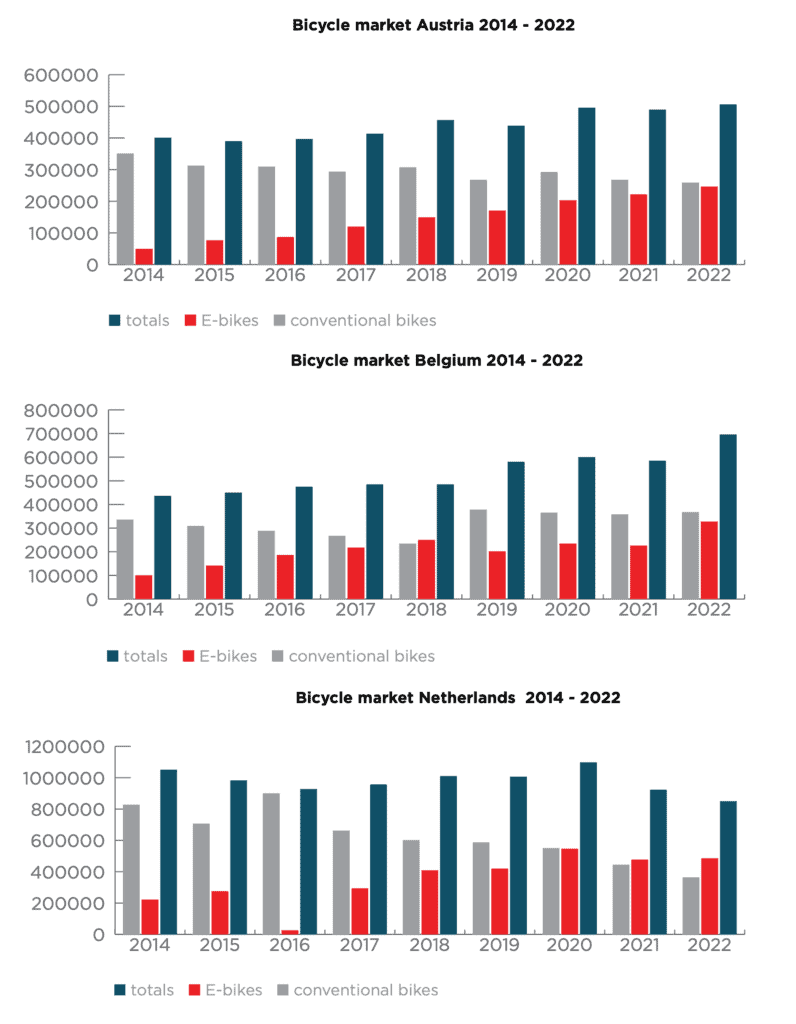

The best-performing markets in 2022 were Austria, Belgium and Germany. The latter is good news as it is Europe’s largest market for bicycles and e-bikes both by units and by turnover. While the overall number of units sold dropped by 100,000 to 4.6 million, the number of e-bikes sold by 10 percent to 2.2 million while conventional bicycles dropped by 11 percent to 2.4 million. Due to the significantly higher average price of e-bikes, this resulted in a new record turnover of € 7.36 billion. In Austria, sales of e-bikes grew by 11 percent year-on-year to 246,728 units and the overall market grew by 3.2 percent to 506,000 units, creating a record turnover of € 1.39 billion with parts and accessories adding another € 200 million.

Despite the relatively positive numbers, a closer look at the German and Austrian markets – which are so important in terms of purchasing power – reveals that the current economic difficulties are clearly felt here as well. Well-known wholesale distributors such as Cosmic Sports, Sport Import (both Germany) and Thalinger Lange (Austria) all report persistently high inventory levels. Although these have been reduced during this season, a comparatively cold and rainy summer as well as continued high inflation rates caused inventories to decrease more slowly than expected in many places. To counteract the high product pressure, distributors therefore implemented various measures such as sales campaigns, aggressive discount scales, and purchasing halts.

When talking to a selection of large Swiss distributors at Lenzerheide’s Test Ride event in early September, executives estimated turnover to be down by 5 to 10 percent year on year for the first eight months of 2023. Depending on the product category a complete reduction of inventory levels and thus a relaxation is not expected until the end of 2024 or even as late as 2025. However, the general sentiment remains: there is light at the end of the tunnel, and the overall mood at Eurobike this year was fundamentally positive and optimistic.

The situation is likely similar in other European markets. However, the figures also show here that although the record growth of the 2020 and 2021 seasons had collapsed, the strong demand for e-bikes continued to support high sales. Somewhat surprisingly, the mostly flat Netherlands are the country with the highest market share of e-bikes in Europe – and most likely worldwide. In 2022, this market share grew to over 57 percent or 486,000 of a total of 855,000 units. Thanks to the high demand for e-bikes, the overall turnover grew slightly by 0.9 percent. The most dynamic e-bike market in 2022 was Belgium where the units sold grew by an impressive 45 percent year-on-year, bumping the market share to over 47 percent. As another country showing eroding sales of conventional bikes and a dynamic growth in sales of e-bikes, Italy saw the turnover of its market grow by 18 percent year on year despite the units dropping by 9.2 percent to 1.77 million.

The French market saw overall growth of 5.2 percent to € 3.6 billion, with sales of bicycles growing by seven percent to € 2.4 million. This was mainly due to e-bikes, which grew by 12 percent to 738,000 units, resulting in a market share of 28.4 percent. As an outlier, the bicycle market in the United Kingdom fell by 22 percent to 1.88 million units, dropping to a 20-year low. The main reason for this is the cost of living crisis that has been hitting the UK even harder than the EU region. With a market share of just 7 percent, the e-bike market is still in its infancy, and seeing the government retreat from investments in bicycle infrastructure certainly did not help either.

In the United States, the bicycle market grew by 14 percent year-on-year to US$ 5.91 billion in 2022. Meanwhile the bicycle market in Canada has seen a drop in units compared to 2021, but was still operating at a higher level than before the pandemic. As for the first half of 2023, the numbers published by market listed key players offer some hints, showing the ongoing effects of high inventory levels and low consumer sentiment. Shimano reported a minus of 17.7 percent year on year in turnover for the first two quarters of the year, and Fox Factory saw the turnover of its Specialty Sports Group drop by 35.6 percent.While these numbers may sound alarming, Taiwan’s two largest bicycle manufacturers performed a whole lot better throughout the first two quarters: Giant Group recorded a minus of 5.4 percent in turnover, with strong demand in China offsetting some of the losses recorded in Europe and in the United States in particular where business was down by 44 percent. Merida Industry saw its turnover decline by 6.6 percent year-on-year, with the second quarter performing worse than the first. As for the inflation and the cost of living as key factors for consumer sentiment, the bicycle industry is a victim of factors beyond its control – most obviously Russia’s war in Ukraine, but also the post-pandemic economic turmoil facing the People’s Republic of China, in particular its real-estate sector.