Focus on high-end complete bikes keeps Taiwan’s industry afloat

Delays in production and a drastic slump in demand have filled up inventories along the entire supply chain. While the focus on e-bikes and high-end conventional bicycles and a diverse range of export markets kept the losses in Taiwan’s exports of complete bicycles within bounds, parts and components have taken a heavy hit this year.

Whether at the Taipei Cycle Show or at the Eurobike show in June: discussions were dominated by the overstocking problem and how to deal with precariously high inventory levels. While this situation may be favorable for consumers who get to choose from various options and still get to enjoy healthy discounts when purchasing a bicycle, it is a real headache for the bicycle industry. High inventory levels are eroding the price structure and eat into margins, hurting the balance sheets and squeezing liquidity due to a combination of lower turnover and higher operational costs.

This challenging combination has already caused serious trouble with some market players, with Dutch D2C brand Vanmoof as the most prominent victim thus far going bankrupt, leaving losses with both suppliers and investors in Asia. How bad is the situation really, and how is Taiwan’s heavily export-oriented bicycle industry dealing with this situation? Apart from contacting various companies to ask them directly about the state of their business, the provisional export statistics provided by the Taiwan Bicycle Association (TBA) and the Bureau of Foreign Trade’s (BOFT) information center give us some interesting insights on how the industry is doing in Taiwan.

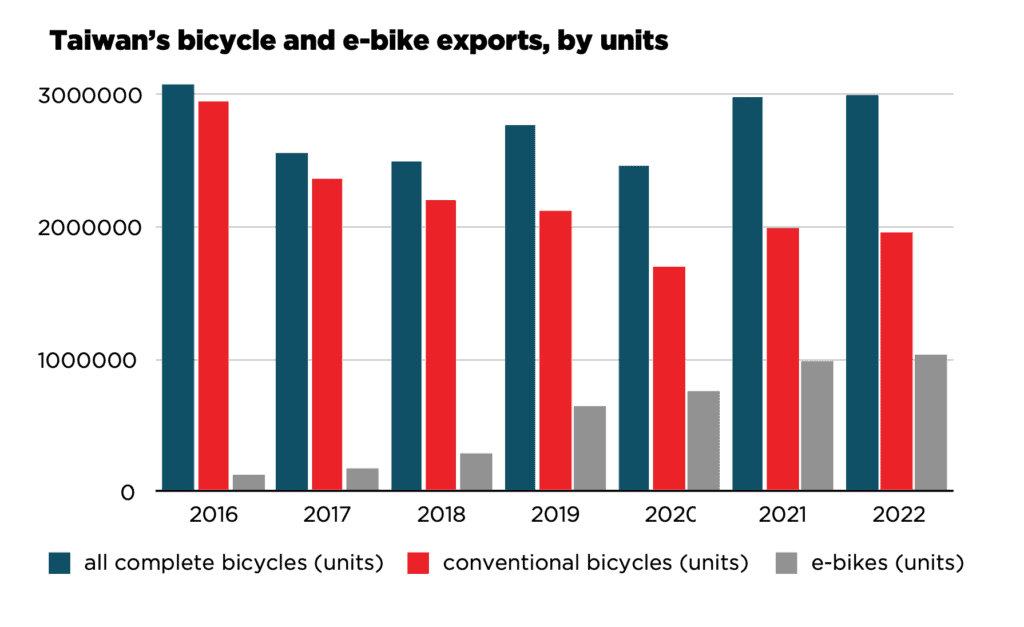

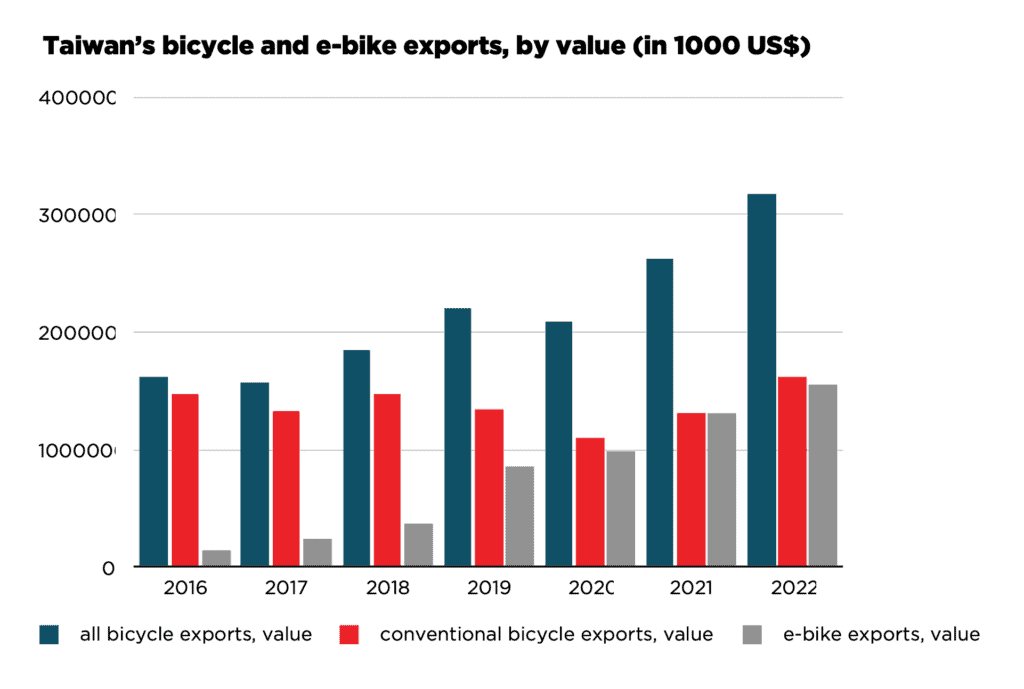

Since these export numbers are compared year-by-year, a look back at last year’s numbers is well-worth the effort. In 2022 the exports of Taiwan’s bicycle industry bucked the slowing economies in key markets. There are two key factors for the continued growth of the country’s bicycle exports: First the ongoing high demand for e-bikes saw the units exported grow by almost 5 percent and exceed the 1-million-threshold for the first time ever. A second significant factor is the rise in average unit prices that grew by over 25 percent to US$ 827.73 for conventional bicycles and by 12.5 percent to US$ 1497.48 for e-bikes.

A close look at Taiwan’s export statistics for 2022 shows a significant slow-down in the fourth quarter however, and this trend further deepened into 2023. The quarterly results of some key component suppliers are a strong indicator for wide-spread cancellations, downscaled forecasts and a delayed launch of the 2024 model year due to high inventory levels. While Shimano reported a fall of 17.7 percent in turnover for its bicycle division in the first two quarters, the situation looks even more dire for the Specialty Sports Division of Fox Factory, where turnover for the first two quarters dropped by 35.6 percent. Both with Shimano and Fox Factory the results for the second quarter were weaker than for the first.

So how did these challenging circumstances impact the exports of Taiwan’s bicycle industry in those two quarters? It is a tale of two conflicting trends really: While the units exported dropped by 18.99 percent for conventional bicycles and by 9.95 percent for e-bikes (the respective numbers for January to August stand at -23.46 percent and -19.76 percent), a look at the turnover generated by those exports tells a different story. The 782,009 conventional bicycles exported from January through to the end of June generated a turnover of US$ 752.19 million – an increase of 6.32 percent (US$ 1.005 billion and + 0.18 percent from January to August). Likewise the 446,778 e-bikes that were exported generated a turnover of US$ 740 million or a plus of 1.76 percent (US$ 920 million and -8.43 percent from January to August) when compared to 2022. Keep in mind that this was a record-breaking year.

The reason for these two conflicting trends of course is a sharp rise in the average price per unit exported: this grew by an impressive 31.25 percent year on year to US$ 961.87 for conventional bicycles (US$ 1008.25 from January to August). The corresponding average price for all of 2022 stood at US$ 827.73. As for e-bikes, the growth may have been less dynamic with a plus of 13 percent to US$ 1656.34 (US$ 1694.38 from January to August). For all of 2022, this average price had reached US$ 1497.48. This development is no coincidence but rather a reward for the bold strategy of large parts of Taiwan’s bicycle industry and TBA to focus its efforts on the upper-end of the market and e-bikes in particular. This also shows in the numbers of the Giant Group and Merida Industry for the first two quarters, reporting moderate drops in turnover of 5.4 percent and 6.6 percent respectively.

Another factor that reduced the impact of high inventory levels on Taiwan’s bicycle industry lies in the diversification of its key markets. While exports to the United States saw a sharp drop, the EU region fared a lot better thanks to a much higher market share of e-bikes. And China even saw dynamic growth in demand for high-end road bikes, although the small volume did little to compensate for the fall in the United States and EU. Other relevant markets for conventional bicycles such as Japan, South Korea, Canada and Australia showed no consistent trend throughout the first half of this year apart from rising average prices per unit.

As for the exports of parts and components, the situation looks grim. High inventory levels in target markets are having an impact in addition to cancelled orders, meaning both the aftermarket and the OE business of suppliers are down. From January to August, parts and components exports dropped by 48.94 percent to 27.08 million kilograms and by 37.93 percent to US$ 1.286 billion in value. As a consequence, overall exports of Taiwan’s bicycle industry saw a drop of 21.29 percent to US$ 3.211 billion. As a silver lining, unit prices were rising, and many of those parts and components are not strictly linked to a model year, lessening the pressure to discount to speed up sales.