Funding for bicycle infrastructure and the accelerated growth of European production are among the industry’s targets in talks with the European Commission, which should lead to a comprehensive report on mobility later this year.

The EU Mobility Transition Pathway (MTP) involves cycling and three other mobility sectors, and the report with input from all parties should be finalised over the coming months to help shape European policy.

“We think that there should be the recognition that the bicycle industry is a mature industry, which deserves to be supported financially,” said Manuel Marsilio, general manager at the Confederation of the European Bicycle Industry (CONEBI). The funding should go to “development projects that can be beneficial transversally for the bicycle industry.”

CONEBI has been appointed to co-chair round table discussions on the competitiveness of the European bike industry. The Brussels-based confederation works on market data as well as standardization and regulation, such as the upcoming European rules on batteries. Other industries in the MTP are the automotive, waterborne and rail sectors.

The discussions come as the European bike market is grappling with the aftermath of disruption in the last years, which combined outsized demand with upheavals in the supply chain.

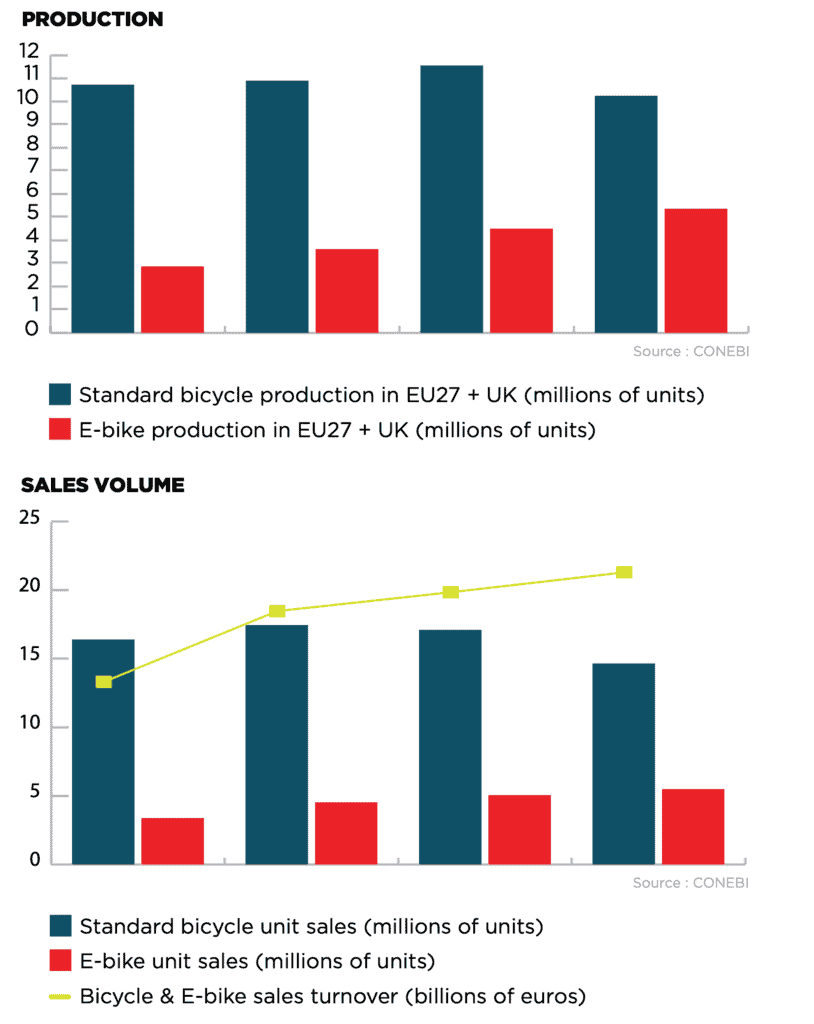

CONEBI puts the market for bicycles and electrically pedal-assisted cycles at nearly €21.2 billion and 20.2 million units in 2022, across the 27 markets of the European Union and the U.K. That was a slump of 9.1% in volume but a jump of 7.4% in value, due to the increasing share of e-bikes. Their sales volume grew by 8.6% to 5.5 million.

Marsilio said traditional bike sales are declining “quite a lot” this year, while the growth of the e-bike market appears to have slowed down.

Leftover inventories have led to wide-spread retail price reductions, and Marsilio indicates that the supply chain probably won’t stabilize until around the end of next year.

The MTP could help the bicycle industry to obtain more funding and incentives as well as political commitment. European bike production fits with the demand for more agile and sustainable supply chains, as well as the European Union’s Green Deal.

Marsilio said the disruption of the last few years has made it abundantly clear that the industry would benefit from having more production in Europe, from frames to components, engines and battery cells.

The number of bikes and e-bikes made in Europe last year contracted by 2.8% to 15.6 million. That was entirely due to standard bikes, while e-bike production jumped by 19.1% to 5.4 million.

CONEBI has seen a shift in attitudes around the supply chain, with more market players getting “quite vocal” about European manufacturing and reshoring of frame production.

“It would be great to see the recognition by the European institutions, and the European Commission first of all, that that can be a strategic project,” Marsilio said. “If the European Union want to do it, politically speaking you have to give support to companies,” he added, to create a level playing field with other markets that stimulate investment in their bike business.

Environmental regulations could influence European production as well. Marsilio mentions considerations such as a carbon tax on imports of some raw material imports into Europe. No such environment-related restrictions are on the agenda for bicycle components, but discussions could arise in the future, he added.

CONEBI’s general manager adds that such policies would aim to stimulate European production for European consumption, and they should not be detrimental to any international partners.

Taiwanese companies have already raised their investment in Europe, and Marsilio predicts that this will continue. “Maybe it’s not a factory, maybe it’s something different, but still I think that we will see a stronger presence of Taiwanese companies in Europe,” he said. They could invest in increased stocks of components in Europe, or other ways to serve European customers more flexibly.

Marsilio suggested that political commitment could also help to ensure a reasonable distribution of resources such as battery cells between the bicycle and automotive industries.

“Let’s assume that there will be a lack of cells in the future for electric vehicles (…) we would like to receive a commitment by the European institutions that there will be fair competition, a level playing field when it comes to the supply of the cells for our batteries,” he said. “We should be able as an industry (…) to have all the means to produce our batteries, to compose our battery packs, instead of giving up again and again to the big automotive industry, which has always received a lot of funding in the past.”

At the same time, Marsilio said the industry wants more investment to stimulate cycling. Measures taken by European governments in the last several years ranged from investments in bicycle lanes to rebates on bicycle purchases and repairs, lowered VAT rates and other forms of fiscal support.

He mentioned countries such as France, which has launched a comprehensive strategy to push the cycling industry, involving public stakeholders and the private sector. The Plan Vélo unveiled by the government in May includes a budget of €2 billion over the next four years to stimulate cycling, infrastructure and the industry. Combined with regional budgets, the investment could add up to €6 billion by 2027.

It remains to be seen how much potential is left in the more mature markets, such as the Netherlands and Denmark. But Marsilio said several factors could encourage continued growth, such as lack of space, reduced speed limits and congestion. They could lead more households to use cargo bikes and e-bikes instead of a second car, as a complement to their regular bike.

Another “fundamental” issue in the European discussions is the regulatory framework around electric vehicles and cargo bikes, which have fueled the market’s growth. “We need to receive the kind of confidence that companies can invest because the e-bike will continue to be seen as a bicycle,” said Marsilio.

European discussions are coming up to revise the classification of vehicles. Their classification as motorcycles would have far-reaching consequences around helmets, circulation, insurance, number plates and more. Yet another priority for CONEBI is that Europe sticks with its trade regulations on the import of bicycles and e-bikes into the European Union.