There has been a lot of talk about the de-industrialisation of Europe. With the Covid-19 pandemic disrupting global supply chains, the wisdom of outsourcing all of the production has come into question. In response, many German companies have rediscovered the advantages of “Made in Germany” and the benefits of producing close to the market – but also some challenges.

Starting in the 90s, many industrial manufacturers started to move their production from Europe to the Far East — mostly to China. This outsourcing yielded higher profits, filling the pockets of investors and shareholders. The bicycle industry followed in the steps of other sectors. Taiwan’s bicycle industry invested heavily in additional production capacities in China as well, and for a while this looked like a win-win situation for everyone involved.

Some German suppliers were part of this move: while Humpert [hall 12.1 / B23] had been producing up to 4.5 million handlebars per year at its German headquarters in its heyday, that number shrank to just half a million units as aluminum handlebars with a 31.8 mm clamping diameter became the norm and could not be produced profitably in Germany.

Other German suppliers decided to move part of their production to Asia to meet the increasing demand of assembly plants in Far East. One example of this is Abus [hall 12.1 / A29]: while the production of bicycle locks has been carried out in Germany since the foundation of the company in 1924, Abus is banking on producing close to markets with high demand.

“More than 30 years ago we set up a subsidiary in Asia with its own management but close links to the parent company in terms of production and development. But over the last 20 years production in Germany has seen stronger growth,” recalls Daniel Bremicker, general manager mobile security at Abus. Following the expansion of its factories in Rehe and Jahnsdorf, the frame locks of Abus can now be “Made in Germany” as well. At both sites, Abus has its own machine engineering and tooling departments and the company also educates and trains the next generation of experts.

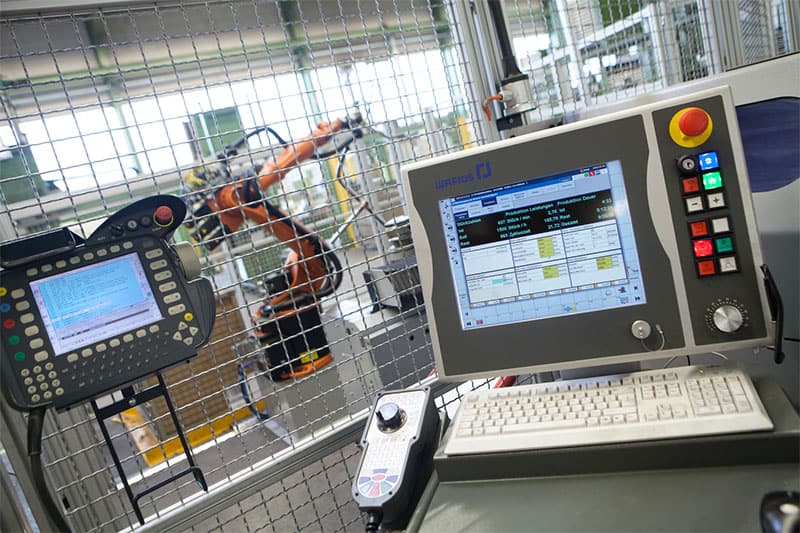

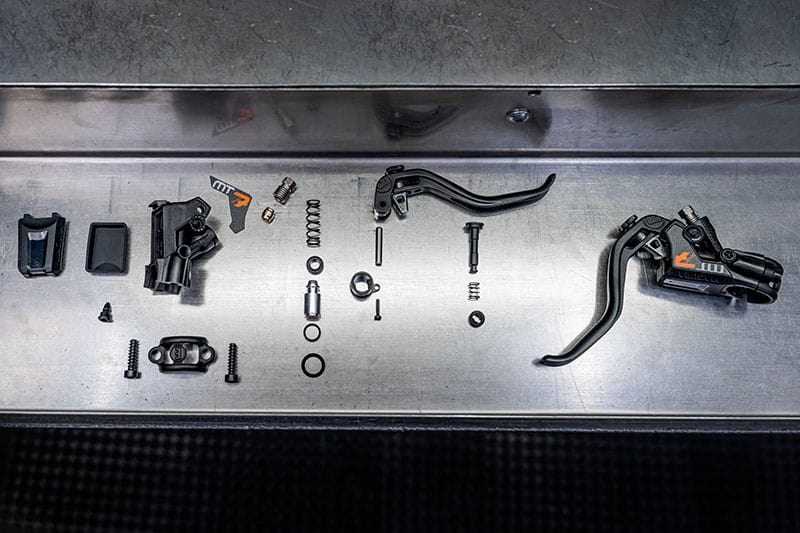

Despite its strong industrial footprint in the Schwäbische Alb area next to its Bad Urach headquarters, Magura [hall 12.0 / B08] is a similar case, as CEO Michael Funk explains. “Short supply lines offer the same advantages, namely flexibility and fast deliveries, in Far East as they do in Europe. For this reason, Magura has set up production in Taiwan while still being one of the few companies in the bicycle industry to carry out mass production of key components in Germany.” While the injection moulding department is highly automated and runs constantly in three shifts, the assembly of the various brake systems still relies on a lot of human labor that is all the harder to find as higher skilled workers are needed. This was one of the reasons many companies relocated their entire production to Asia, a move which backfired during the supply disruptions of the Covid-19 pandemic, provoking delayed deliveries and shortages in goods.

Long supply lines have other negative implications, as the recent past has shown. SKS Germany’s [hall 12.1 / A26] distribution manager Marcel Spork explains that the company has stuck to domestic manufacturing because “keeping all the steps in-house, from concept to prototype and then production has huge advantages in terms of quality and the protection of intellectual property. For this reason SKS has been relied on producing in Germany since the company was founded in 1921.” Long distances, different time zones and mentalities and language barriers can cause all kind of issues and misunderstandings as well. And while frequent intercontinental trips were seen as a minor hassle by most product managers before the pandemic, the travel restrictions imposed from 2020 to 2022 proved to be more problematic.

For Robert Heine, member of the board at Heine + Beisswenger Gruppe, parent company of internal transmission hub maker 3×3 [hall 8.0 / J20], physical presence simply cannot be substituted by virtual meetings. “Apart from advantages in terms of reliability and the actual ability to supply goods, close proximity is a big plus when keeping a close eye on quality control, manufacturing conditions and compliance with environmental guidelines – the latter being key aspects in terms of sustainability.” Proximity to the markets not only makes for shorter delivery times but also helps to reduce the emissions associated with transporting goods around the globe – an important element in reducing the eco-footprint of the bicycle industry.

Another big issue with long supply lines is a lack of flexibility, linked to the question of how to get to a realistic forecast. Consumer sentiment has been extremely volatile over the last three years, from the first shock in the early days of the pandemic to skyrocketing demand in key markets such as Europe and Northern America that provoked a mad rush for goods, followed by a slump in demand caused by inflation and uncertainty after Russia’s attack on Ukraine. “With frames made in Asia, I get two large deliveries a year and can only adjust my order once per model year. It’s a different story with our Advanced frames built by composite injection molding in Germany — I can order smaller batches of frames month by month, which is key to keeping up with quick changes in demand as we’ve experienced in the last three years,” explains Helge von Fugler, CEO of Ebike Advanced Technology [hall 12.0 / A06].

While the reshoring movement was already gaining traction before the pandemic, due to the EU’s anti-dumping duties against Chinese-made e-bikes, the many disruptions wrought by Covid-19 further accelerated the trend. Bicycle brands started to look for alternatives within Europe to source the frames, components and parts they needed – and to get their bikes assembled closer to their markets. And since Germany is the largest bicycle market in Europe, “Made in Germany” became a sought-after attribute. It has always been that way for gearbox specialist Pinion [hall 12.0 / B18], as Head of Marketing & Design Dirk Menze points out: “We chose the Stuttgart region in Southwestern Germany for our headquarters from the very start as this is the heart of Germany’s automotive industry, and we are tapping into this world-leading know-how to keep innovating in our field of expertise.”

The same goes for SKS Germany, where 90 percent of the turnover is produced at various sites in Germany. As Marcel Spork puts it: “During the pandemic, the advantages of producing close to the markets became very obvious. We were much more flexible and could react to changes in the market quickly. The big challenge for every industrial player looking to manufacture in Germany are the differences in average salaries, certainly when compared to the Far East. But some of the comparative disadvantage can be compensated with know-how, a strong brand and ongoing investments in terms of automation. At SKS, we just expanded our product portfolio into alloy carriers and invested in machinery to produce these. We have also invested to expand the production of composite fenders and next we plan to expand both the warehouse and the offices.”

Humpert is looking to bring back the production of volume segments of its portfolio that were outsourced over a decade ago, according to marketing manager Katarina Humpert: “We are currently working on bringing the production of alloy handlebars back to Germany. For this, we have developed and installed two fully automated machines at our main facility in Wickede. Mass production of alloy handlebars with a clamping diameter of 31.8 mm is about to start.” Ergotec’s new Active Flex grips are also made in Germany, but by a production partner. Humpert is looking to set up a similar solution for the production of stems and seat posts as well, pointing to shortened delivery channels and reaction times, the reduced need to build up stocks in warehouses and the advantages in keeping control of the production and making it more sustainable as the main advantages of bringing production to Germany.

Things are a bit different with ergonomics specialist SQlab [hall 11.1 / B24], as the company’s founder Tobias Hild points out: “From the start we have relied heavily on production in Taiwan, and we’ve always been happy with the quality, the cooperation and the pricing. But when we wanted to try new materials and production technologies, the long distances proved to be a problem. At the same time we linked up with a senior employee of BASF, and from there we got into contact with Oechsler as a potential production partner in Germany. One result of this cooperation that is also competitive in terms of pricing is the new 611 Infinergy Ergowave Active 2.1 saddle that will hit the market in Q3 of this year, and another result is our modular concept ClipON, a world’s first.” According to Hild, another advantage of producing in Germany is that calculating the carbon dioxide footprint of each product is much easier.

Ebike Advanced is a similar case as it was one of the development partners of V-Frames, a spin-off of Saxonian injection molding specialist Isoco, in finding ways to build bicycle frames from thermoplastic composites. The solution Advanced and V-Frames came up with is highly automated and allows for the production of one e-bike frame every 90 seconds. At the end of its lifecycle or if a frame does not pass quality control, it can be shredded to a granulate and reused to build new frames. While this is a promising step towards a circular economy, the big challenge lies in the high tooling costs that need to be offset by sufficient volume.

Only a few of the companies that Show Daily reached out to produce large volumes in Germany. Since the “Made in Germany” label is supposed to signal quality and a certain exclusivity, this makes sense. And as a motor for ongoing innovation, Germany remains a driving force within the bicycle industry.