At the beginning of 2022, all signs seemed set for new growth records. But inflation and a drastic drop in consumer sentiment in key markets threw a spanner in the works, and business was sluggish for many Taiwan-based manufacturers in the second half of the year. All the same, the overall numbers look pretty good.

There’s no doubt that the Covid pandemic has put some great strain on societies and health systems in various countries. But at the same time the market for bicycles, parts and accessories saw a strong boost throughout the pandemic. In key markets such as the European Union and the United States, people swapped workouts in gyms for training rides, trips on public transport for bike rides and holidays abroad for stays at domestic destinations, exploring their own backyard on foot or by bike. The result was a high demand for bicycles that provoked persistent bottlenecks in merchandise and pushed the bicycle industry to the very limits of its production capacity and beyond. To counter the bottlenecks, bicycle dealers and distributors further increased their orders, resulting in a bow wave of backorders and lead times that multiplied.

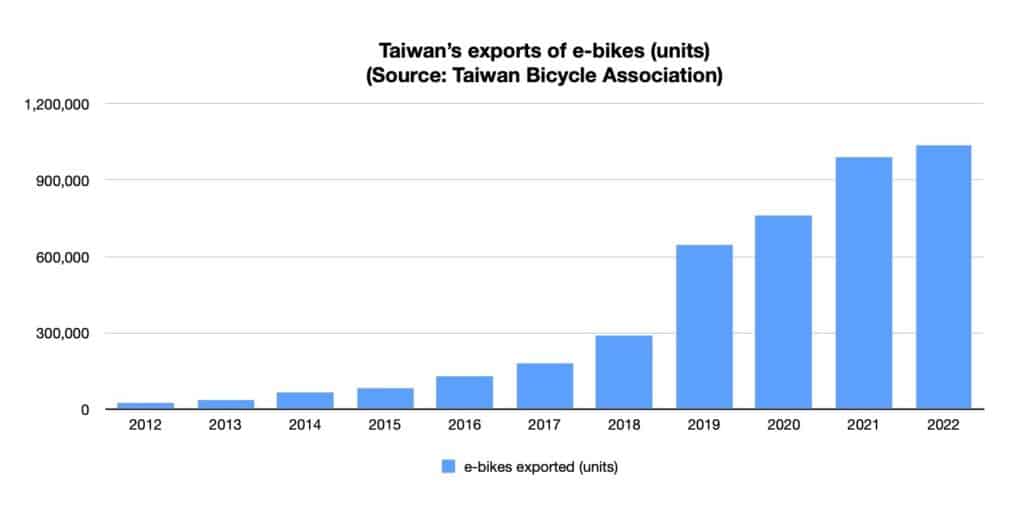

Factories in Taiwan were running at more than full capacity to keep the situation under control and customers happy. In 2020, the exports of Taiwan’s bicycle industry grew by 18 percent in volume and 14 percent in value, and this was just the beginning of a wild but short-lived boom. In 2021, the exports of conventional bicycles grew by 17 percent in units and by 19.7 percent in value while the exports of e-bikes grew by a staggering 30 percent in units and 33 percent in value. Parts and components fared even better with a plus of 44.15 percent in tonnage and 58.2 percent in value. The supercharged growth of Taiwan’s exports continued well into 2022, with overall exports growing by another 28 percent from January to April. Again parts and components showed the strongest growth at 42.7 percent, with conventional bicycles posting year-on-year growth of 20 percent and e-bike exports growing by 12.8 percent.

Just when the pandemic seemed to ease off and people were looking forward to return to a new normal, Russia’s attack on Ukraine sent prices for energy and many raw materials soaring. The resulting inflation tanked consumer sentiment in key markets, and as a consequence inventory levels quickly grew to worrying levels at bicycle dealers and distributors. This provoked a cascade of cancellations: a seven-digit number of bicycles disappeared from order books, cutting into the business of many suppliers and bicycle manufacturers in Taiwan and causing issues with storage capacity and cash flow. When the Taipei Show Daily visited manufacturers in Taiwan in November 2022, the mood was decidedly somber – due to external factors the gold rush seemed to be over. And roughly a quarter of expected business had disappeared at short notice.

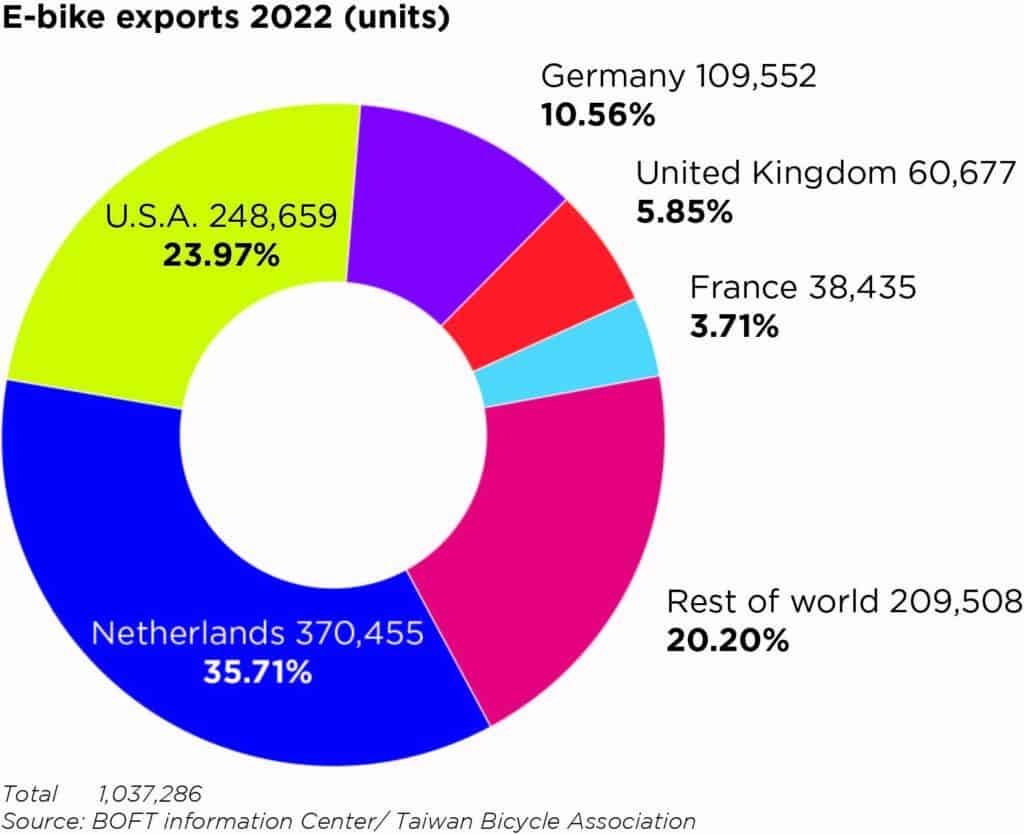

So how did the situation look at the end of the year 2022? The Taiwan Bicycle Association (TBA) provided provisional export numbers, and these do not look all that bad seen the recent doomsday reporting in many publications. Keep in mind that these numbers for 2022 are being compared to a very strong year 2021 that had lifted Taiwan’s bicycle industry to new record levels. At the end of the year 2022 Taiwan had exported more than one million e-bikes for the first time ever. The export counter stopped at 1,037,286 units, resulting in a growth of 5.1 percent. Since the average value of exported e-bikes grew by 12.5 percent to US$ 1497.5, the overall value of these exports stood at US$ 1.553 billion, a growth of 15.9 percent. The most important markets for these exports were the Netherlands, the United States and Germany, accounting for more than two thirds of Taiwan’s total e-bike exports.

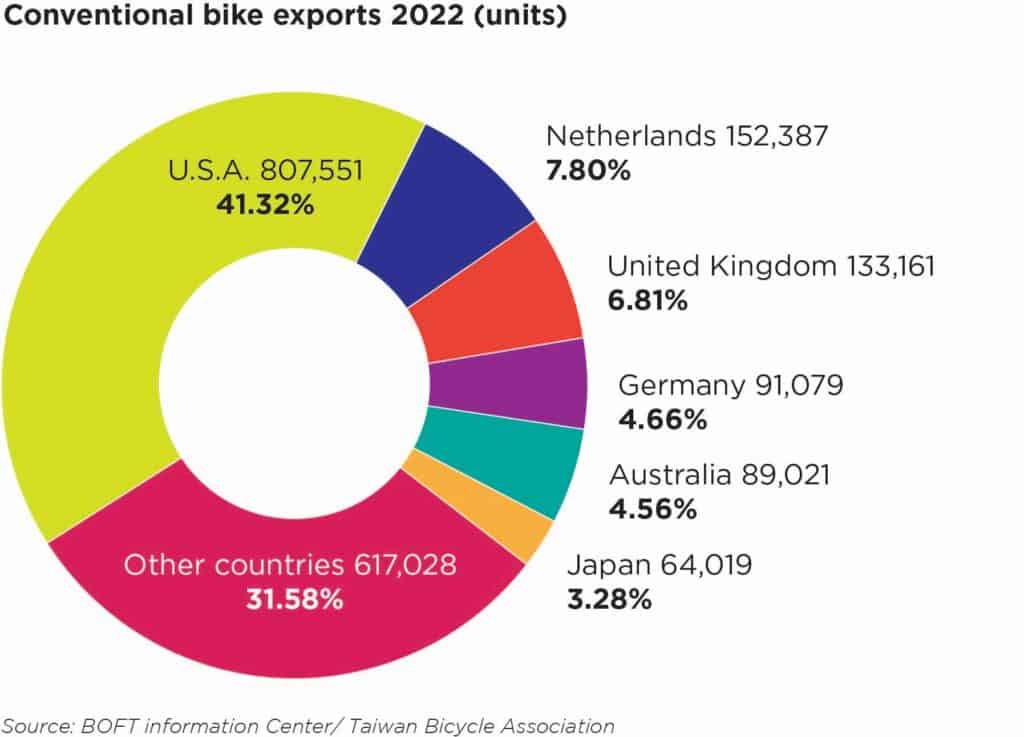

As for conventional bicycles, Taiwan’s exports in 2022 came to a total of 1,954,246 units, marking a 2 percent drop year-on-year. But the value of these exports still grew by 20.6 percent to US$ 1.617 billion. This increase most likely can be credited to Taiwan’s focus on mid- to high-end models that were less affected by the slump in consumer sentiment than entry level and low-end models. The fact that the average price of Taiwan’s exported conventional bicycles grew by 25 percent to a new all-time high of US$ 827.73 year-on-year supports this explanation. For conventional bicycles the United States is Taiwan’s most important market by far, accounting for over 40 percent of exports. The Netherlands, the United Kingdom and Australia account for less than 10 percent each. Made in Taiwan folding bikes did very well as the exports grew by 5.4 percent year-on-year to 15,161 units and by 36 percent in value to US$ 10.375 million. The key markets for these bicycles were South Korea, China and Japan.

A serious portion of Taiwan’s bicycle-related exports are not complete bikes but components and parts, ranging from frames and forks to wheels, products covering various contact points and spare parts. This category showed little sign of weakening in 2022: while the exported tonnage only grew by 4.06 percent, the value of these exports jumped by 26.43 percent to US$ 3.013 billion. This amount almost equals the combined exports value of e-bikes and conventional bicycles. While wheel-related parts, derailleurs and brakes saw significant growth, the export of electronics, saddles, pedals and inner tubes all suffered set-backs of various degrees in terms of units exported, but not necessarily in the resulting value of the exports.

For 2023, Shimano is forecasting a drop of 23 percent for its bicycle components business. This reflects the ongoing slump in consumer demand, the insecurity caused by the war in Ukraine and the sluggish business due to order cancellations. At the same time the pipeline is full with inventory that covers demand for an entire year. It will be interesting to see how Taiwan’s bicycle industry copes with this challenge in 2023. As a silver lining the current situation lends itself to training new staff – if they can be recruited – and to optimize the set-up and the procedures within existing factories.